Table Of Content

ACV factors in the depreciation of property when granting you reimbursement for a claim, whereas replacement cost grants your reimbursement by considering the price of giving you a new, similar item in the current market. Where you live has the biggest impact on homeowner's insurance premiums. Homeowners insurance premiums are based on the property's value along with other factors. Resorts, retirement communities, and cities with rapid growth also have higher property values, and higher property values mean higher premiums.

Average home insurance cost by credit rating

Life Insurance Calculator - How much life insurance do I need? - Bankrate.com

Life Insurance Calculator - How much life insurance do I need?.

Posted: Fri, 11 Mar 2022 20:29:53 GMT [source]

The state you live in may also determine what perils are excluded from standard home insurance policies. Regions with frequent threats of loss from tornadoes and hurricanes may have wind and hail exclusions. For example, Texas windstorm insurance is an endorsement purchased by many residents with homes near the Gulf of Mexico. And some Florida home insurance policies can include a separate hurricane deductible.

How to Estimate How Much Home Insurance You Need

Homeowners Insurance: Average Rates, Coverage, and What to Expect - Business Insider

Homeowners Insurance: Average Rates, Coverage, and What to Expect.

Posted: Mon, 06 Mar 2023 08:00:00 GMT [source]

If that doesn't sound ideal, most insurance providers will let you upgrade your personal property claim settlements to replacement cost value (RCV) for an additional fee. With RCV coverage, your insurer would reimburse you for the value of a new, similar couch at today's prices. When you receive an RCV reimbursement, you'll first receive an ACV check for the item followed by its recoverable depreciation amount after you make the purchase. A standard home insurance policy covers personal belongings on an actual cash value (ACV) basis by default. This means if, say, your couch is damaged or destroyed and you file a claim, you'll only be reimbursed for the depreciated value of the property at the time of the loss. The cost to rebuild your house dictates how much dwelling coverage you should buy.

Can I get a home insurance quote before purchasing my new home?

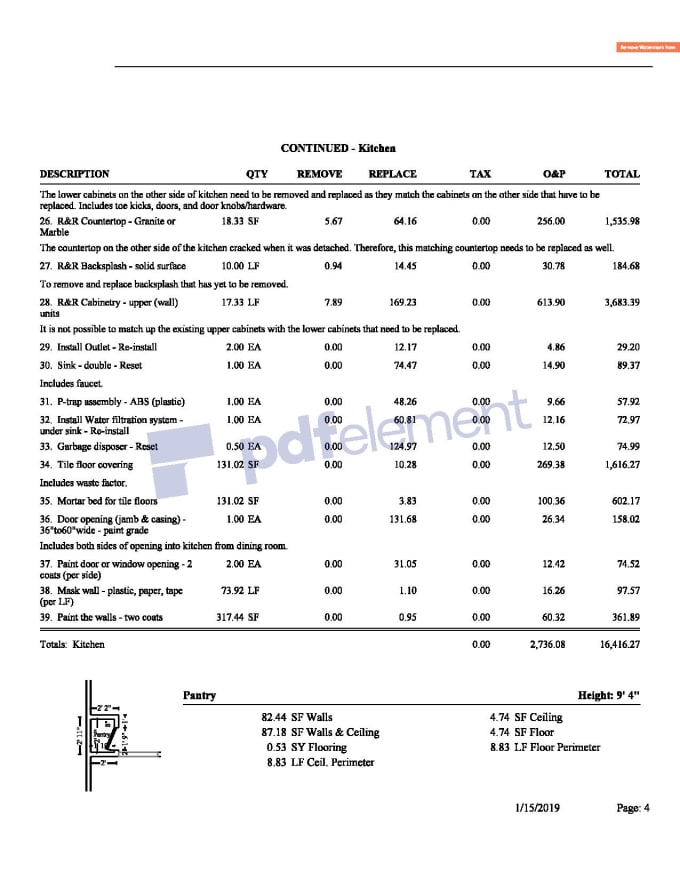

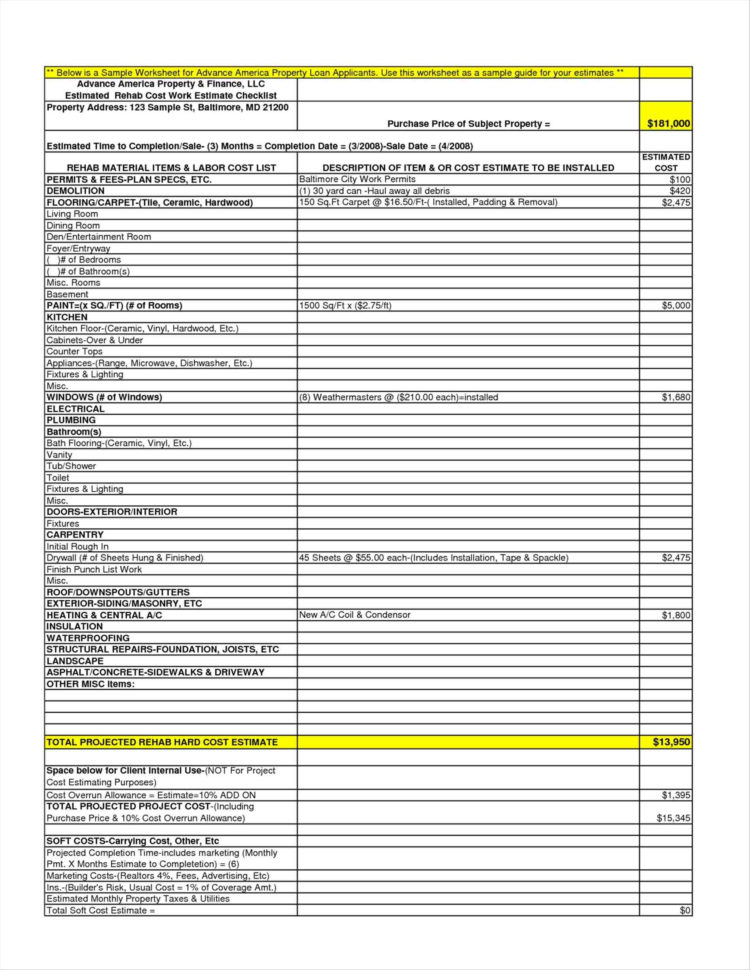

Quickly calculate coverage limits for a homeowners insurance policy, including dwelling coverage, personal property coverage, and personal liability coverage. While home insurance policies include several other coverages that protect everything from your personal belongings to liability, dwelling coverage has by far the biggest impact on your insurance premiums. There are several online calculators that you can use to calculate your dwelling coverage limit, but most insurers should be able to provide you with an estimate when you get a quote. According to our research, Erie has some of the cheapest average homeowners insurance rates in states where it’s available. It also offers guaranteed replacement cost coverage, which aims to give homeowners the total cost to rebuild their homes, regardless of the dwelling limit listed on their policies.

How to calculate your home's replacement cost

Login for quick access to your previous policy, where all of your vehicle information is saved. Mark Friedlander is director of corporate communications at III, a nonprofit organization focused on providing consumers with a better understanding of insurance. Natalie Todoroff is an insurance writer for Bankrate, prior to which she wrote for a popular insurance comparison shopping app. She has a Bachelor of Arts in English and has written over 800 articles about insurance throughout her career. It took less than 5 minutes for me to get a quote, start a new policy and cancel my old one with geico.

What does home insurance protect against?

You should also consider adding replacement cost coverage for your personal property. This covers your belongings for the cost to replace each item new rather than for the actual cash value, which is the depreciated value. Personal property coverage is typically 50% to 70% of your dwelling coverage limits. If you have valuable items, such as fine art, musical instruments, or expensive jewelry, you may need an endorsement to cover them. You need to know how much dwelling and liability insurance you need, what deductible you’re willing to pay and go from there. Then you can use an online home insurance calculator or shop around for quotes.

While selecting lower coverage limits may save you some money on your policy premium, it may undercut the coverage you need throughout the rest of your policy. The proprietary rate data below highlights how dwelling coverage limits affect average homeowners premiums. For example, if you have $200,000 worth of insurance for dwelling coverage, you probably have $20,000 or 10 percent of coverage A allotted for other structures coverage. Depending on your state, you may also have separate deductibles for wind or other storm damage.

All insurance companies have their own way of calculating quotes, so premium estimates can vary widely across insurers. Estimating your home’s rebuild cost is the first step in answering how home insurance is calculated. This figure determines your dwelling coverage amount, which is the limit your insurance company will pay to repair or rebuild your home after a covered claim. The rebuild value is just one factor that will impact your home insurance rates, but it’s important since your dwelling coverage also helps determine the other coverage limits on your policy. To get a better sense of what your home policy might cost, it could help to review average home insurance rates in your state. Some states may not face a high risk of natural disasters, while others have a cheaper cost of living that makes it more affordable to rebuild after a claim.

Personal property covers your belongings, like furniture, clothing, electronics and appliances. Insurance companies usually set personal property coverage at between 50% and 70% of dwelling coverage. Personal property coverage is generally set at 50% to 70% of your dwelling limit. That means that if your dwelling coverage is $500,000 and your personal property coverage is set at 50%, your personal property limit would be $250,000. Completing a home inventory will help you determine your coverage needs.

Nationwide home insurance features a slew of comprehensive coverage options. Here’s an in-depth look at five top rated companies that offer home insurance quotes through Policygenius. Comparing all of these different coverage types and limits can help you determine which quote makes the most sense for your needs and budget. Looking at the two fictional quotes above, you can see that while State Farm has higher premiums than Allstate, you only have to pay $500 when you file a standard claim — versus $2,000 with Allstate. Experts recommend at least $300,000 in liability coverage; if you have a lot of assets you should consider a higher limit. Insure.com’s home insurance calculator leverages thousands of sample rates from across the country, provided by Quadrant Data Services, to provide you with average rates in your area for homes like yours.

If you need additional coverage, consider an umbrella insurance policy. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. ERC will pay to rebuild your home or replace property regardless of inflation, basically making your property the same as it was before the disaster occurred.

From May 20, 2022 to May 20, 2023, 94% of policyholders faced a rate increase at renewal, compared to 90% of policyholders from the previous year. During this time, the average quoted renewal premium was 21% higher nationally compared to the average of what homeowners were previously paying — roughly 9% higher than the 12% increase we reported last year. Finally, get quotes through our online home insurance marketplace, all for free and with minimal information required. All that's required is a few brief details about you and your home, and we'll send you a side-by-side comparison of rate estimates from several insurance providers. Homes that are larger, have outdated electrical or plumbing, or are constructed with obsolete materials will likely see higher rates since they’re either pricier to rebuild or because they face an increased risk of damage.

No comments:

Post a Comment